Services

Asure – Professional Administration for MSA Accounts

Protects and Maximizes Your MSA

Protects and Maximizes Your MSA

It is more important than ever to ensure Medicare’s future interests are protected within your settlements. Asure, Medivest’s Professional Administration service for MSA’s, is a proven tool for settling parties to remain compliant with Medicare Secondary Payer (MSP) obligations.

What is a Medicare Set-Aside Account?

A Medicare Set-Aside Account (MSA) is the result from a workers’ compensation or personal injury claim. A portion of the settlement funds are ‘set aside’ in an account to pay claimants’ future medical treatment that is injury-related, and Medicare covered.

What is at Risk?

Managing a MSA is difficult. If the rules and regulations from the MSP statute for expenditures and reporting are not followed, you could:

-

-

Jeopardize your present and future Medicare benefits

-

Prompt an IRS levy against Social Security or disability benefits

-

Be required to reimburse Medicare or the MSA account

-

Medivest was the first to professionally administer a MSA Account, and has been providing this service since 1998 – longer than any other company in the industry.

As an Asure member, your MSA account is managed by the experienced Medivest team who will:

-

-

Make certain funds are spent down according to the allowable guidelines

-

Communicate with doctors, pharmacists, and DME suppliers for proper billing

-

Negotiate fees for medical services and future surgeries

-

Coordinate benefits with other health insurance plans including Medicare

-

-

-

Prepare required annual compliance documents for Medicare

-

Protect Medicare entitlement by ensuring compliance with Medicare regulations

-

Work with the medical providers and pharmacies of your choice

-

Review and pay all medical provider claims

-

Medivest Asure Makes Utilizing Your MSA Easy

-

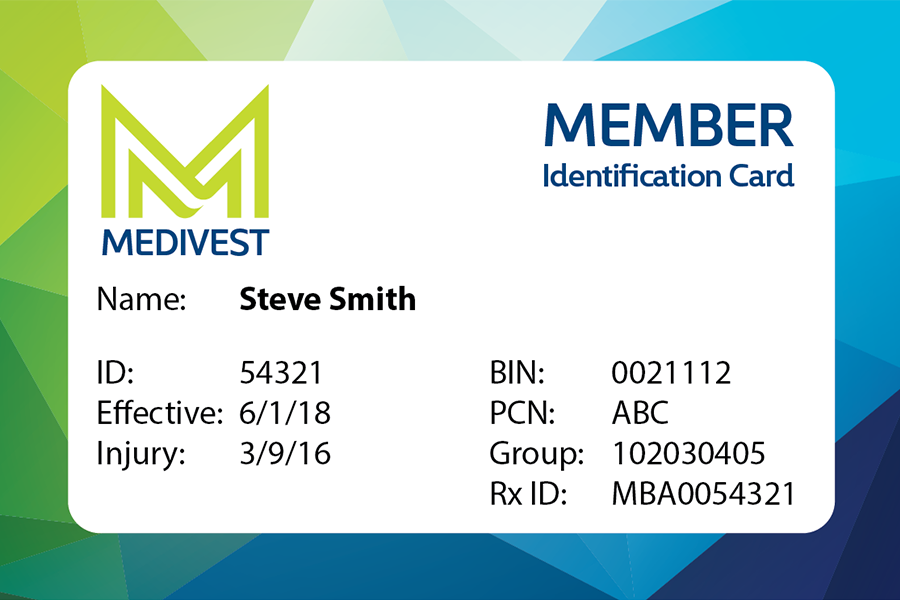

The injured person shows their Medivest Member ID Card to their doctor when they seek treatment, or to their pharmacist when they fill their prescriptions.

-

Their doctor or pharmacist will contact Medivest to verify benefits, just as they would with any other major medical insurance provider.

-

The injured party’s billing notices are then sent directly to Medivest for processing.

No co-pays, deductibles or out-of-pocket expenses when you visit your doctor or fill a prescription for injury related treatment.

Video Guides for Asure Members

Welcome New Asure Member

Welcome new and prospective Asure members. This video will help explain how we will help manage your medical settlement funds, and handle all the paperwork for you.

Asure Member Frequently Asked Questions

Here are the answers to some of the most frequently asked questions that Asure members have about their professional administration accounts.

What Payments are Asure Members Responsible for?

This video will help explain how deductibles, co-pays, or coinsurance balances costs are covered when you have a MSA that is being professionally administered.