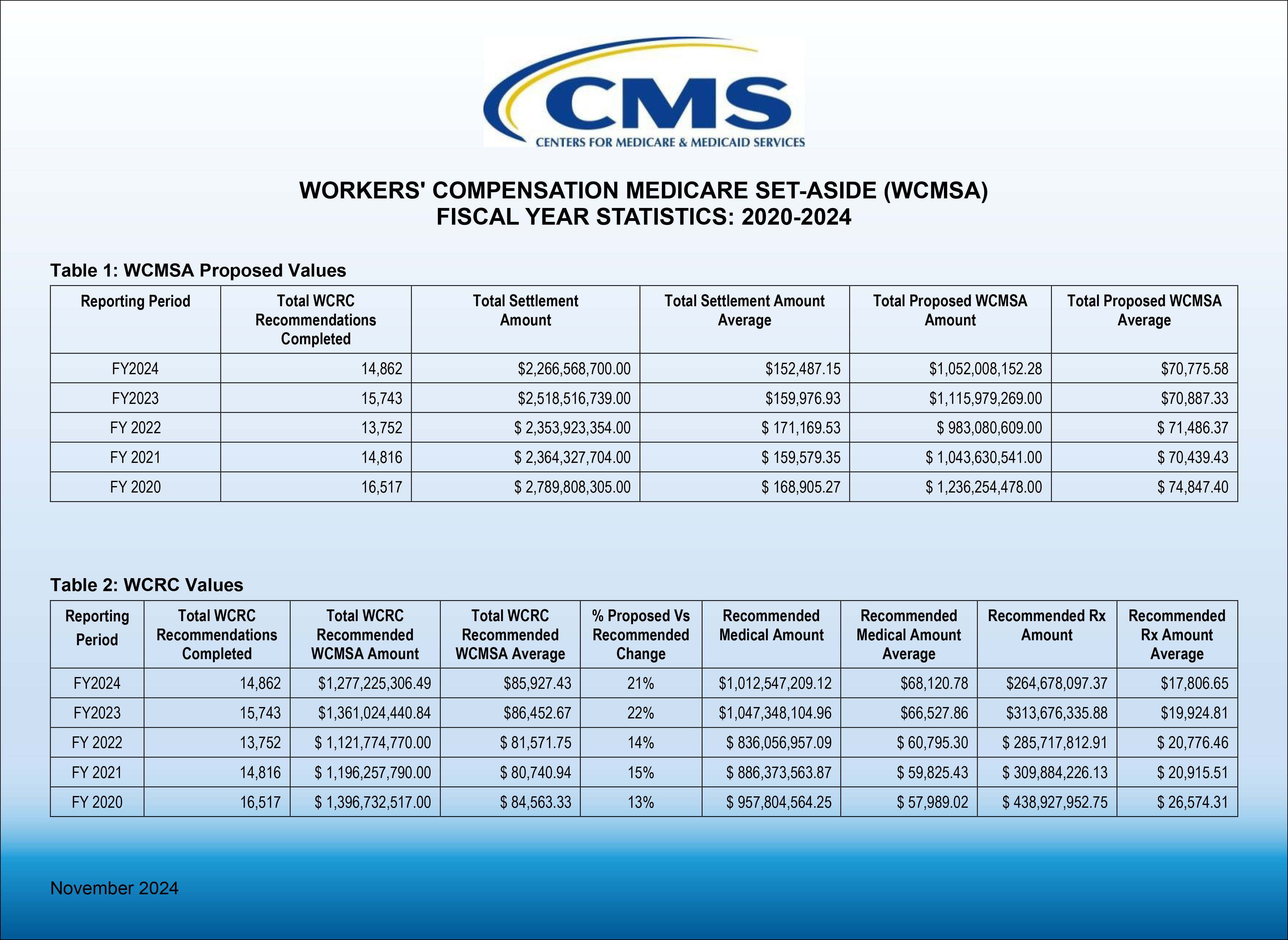

On November 26th, 2024, the Centers for Medicare & Medicaid Services (CMS) shared a new report titled Workers’ Compensation Medicare Set-Aside (WCMSA) Fiscal Year Statistics 2024. The report provides five fiscal years of data regarding Workers’ Compensation Medicare Set-Aside (WCMSA) Proposed Value and Workers’ Compensation Review Contractor Values (WCRC) from 2020 to 2024.

Analysis

There was a 5.6% decrease in the number of WCMSA allocation reports that were submitted to CMS for review from 15,743 in Fiscal Year (FY) 2023 to 14,862 in FY 2024. There was also a drop in average settlement value of 4.7% from an average of $159,976.93 in FY 2023 to only $152,487.15 in FY 2024.

Despite this drop in settlement values, the WCMSA proposals for allocation reports submitted to CMS remained relatively flat, only dropping less than 2/10ths of one percent from $70,887.33 in FY 2023 to $70,775.58 in FY 2024. Counterhighers from CMS, correspondingly remained relatively flat moving from its published increase between the submitted versus recommended amount of 22% in FY 2023 to an increase of 21% in FY 2024.

The biggest change in the WCMSA CMS review statistics in recent years is that in 2022, when Section 4.3 was first added to the Reference Guide, the average counterhigher jumped from a 13-15% increase for FY 2020-2022 to what may be a “new era” for the last two years being between a 21-22% increase. Taking the average of 14% from FY 2020 – FY 2022 to the average of a 21.5% counterhigher increase for FY 2023 – FY 2024, this amounts to 31% increase in the counterhigher percentages!

Proposed MSAs and Total Settlement Amounts

Pre-CMS review WCMSAs constituted around 46% of the total settlement amount in FY 2024 up from 44% in FY 2023.

Medical vs Rx

Medical items and services represented approximately 79.3 % of the approved MSA amounts, whereas Rx represented 20.7% of the approved WCMSA amounts in FY 2024. The medical portion was 76.9% in FY 2023 with Rx accounting for 23.04% of the MSA in FY 2023. In FY 2020 by contrast, the medical portion was 68.6% and Rx expenses represented 31.4% of approved WCMSA amounts. Rx expenses have declined by 34% since FY 2020 as a percentage of the WCMSA . While several factors are likely to be at play here, CMS’ use of sometimes aggressive NDCs to price drugs may be one culprit. Medivest consistently sees submitted MSAs priced using drug NDCs unavailable in the actual market, and well below market average.

Take Aways

While reviews by CMS could in theory include acceptances or even reductions in the amount proposed by submitters as counterlowers, those who submit WCMSA’s have come to know that CMS reviews of WCMSA’s most often come back in the form of a counterhigher. It is important to distinguish a counterhigher from the term counter offer used in contract negotiations. While the WCMSA submission process is entirely voluntary, CMS’s Workers’ Compensation Medicare Set-Aside Arrangement Reference Guide (WCMSA Reference Guide) language and CMS operations consider the CMS review/approval response to be CMS’ final position on the acceptable amount to be set aside to protect Medicare’s future interests in the settlement, unless there is a successful Re-Review (allowed only for instances where there is a math error or the discovery of a document in existence prior to the time of submission but not included in the submission which is then allowed to be provided for the once only Re-Review opportunity). As a result, many in the industry say CMS uses the counterhigher to “voluntell” the parties the amount required to be set aside from their settlement for their WCMSA amount and that if an alternate amount is set aside or no amount is set aside, injury related medicals otherwise covered by Medicare could be denied by Medicare up to the settlement amount minus procurement costs instead of up to the CMS approval amount.

As background, total WCMSA submissions to CMS declined steadily between CMS’ FY 2020 and FY 2022, descending from 16,517 to 13,752, a reduction of almost 17% in three years. FY 2023’s 15,743 submission count seemed to have been a reversal of that trend until the 14,862 number for FY 2024 was reported. This seems to be the market shaking out the initial scare from Section 4.3. in which CMS had for the first time discussed “non-submit” or “evidence-based” MSA allocation reports as potential attempts to shift the burden of payment for injury related Medicare covered medicals to Medicare.

Proposed vs Recommended

While one can understand that CMS wants to protect the Medicare Trust Funds for both Medicare Part A and Part B, it does not seem to be productive for CMS to unfairly punish those who decide to voluntarily submit MSA’s in accordance with CMS WCMSA Reference Guide methodology. The statistics described above show that while the settlements have come down recently, the amount of the submitted WCMSA’s have not, so it’s not as if submitters have been lowballing their submissions. Those carriers who embraced a non-submit program in recent years to avoid higher WCMSA amounts associated with large counterhighers from CMS, may have not yet seen enough consequences to encourage a large return to voluntary submission practices.

The Big Question

These are statistics from those WCMSA’s submitted for approval, meaning they were written by industry-trained professionals in an attempt to match CMS’ recommended methodology. If the industry for those who submit have been consistent, but there has still been an increase in the counterhigher percentages, what has changed at CMS? While the fear in the stakeholder industry used to be focused on financial recovery by CMS under the Medicare Secondary Payer Act (MSP), could it be that CMS’s position concerning non-submitted WCMSA’s is evolving in the form of future Medicare denials for injured claimants who will be left to their own devices to attempt administrative appeals over those denials? The discussions of Section 4.3 of the WCMSA Reference Guide may have just the start of the new era, while CMS continues to build out its computer system in the background. Now, we are aware that there are new Section 111 Reporting requirements include the reporting of WCMSA amounts for all TPOC settlements involving current Medicare beneficiaries whether the WCMSA was submitted to CMS for review or not. Furthermore, the new Civil Monetary Penalty enforcement for untimely Section 111 reporting of ORM and TPOC applicable as of October of this year to be audited in October of 2025 seem to be clear additional steps of the new era, with additional data for CMS to continue to expand Medicare medical and Rx denials in the future. Routine reviews of business practices are prudent in any industry and as we head into another fiscal year, it is a great time to review your business practices to confirm your firm or company is taking the steps to help ensure best in class compliance standards that align with your clients’ interests and risk tolerances.

For Additional Information

Medivest will continue to monitor changes occurring at CMS and will keep its readers up to date when such changes are announced. For questions, feel free to reach out to the Medivest representative in your area by clicking here or calling us directly at 877.725.2467.

Section 10.5 wording change is as follows in yellow highlight:

Section 10.5 wording change is as follows in yellow highlight: