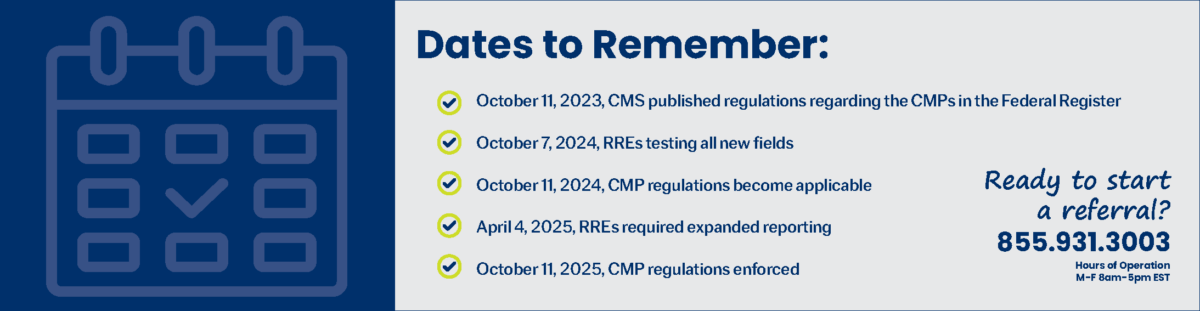

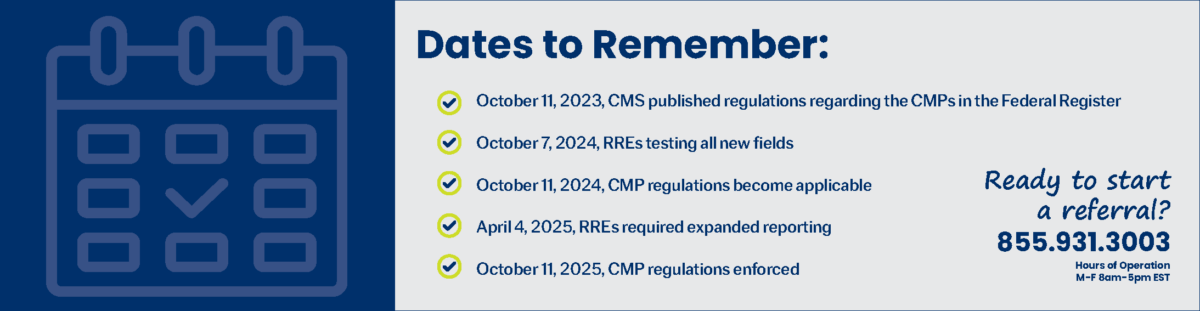

On September 23, 2024, CMS released new announcements regarding Civil Money Penalties. This follows other recent updates and webinars from CMS that have placed additional emphasis on reporting settlement details, and an even greater preference for claimants to use professional MSA administration.

A New NGHP Webpage for Civil Money Penalties

A new webpage for NGHP Civil Money Penalties (CMP) for Section 111 Reporting is now available. Click here to view it. The new webpage is a tool for Responsible Reporting Entities (RREs) to comply with Section 111 of the Medicare, Medicaid, and SCIP Extension Act. The RREs are required to report to CMS regarding the Medicare beneficiaries including information about liability insurance (including self-insurance), no-fault insurance, and workers’ compensation claims where the injured party is a Medicare beneficiary. The new page offers details on the CMP Final Rule, a CMP Workflow Chart, and more.

Expanding Reporting Requirements

The increased MSA mandatory reporting requirements fields enhance oversight and ensure proper coordination of benefits. Historically, CMS has had limited or incomplete information on MSAs which is why CMS has expanded the existing S111 mandatory reporting requirements. The expanded data fields will capture information on all WC claims involving Medicare beneficiaries who received a settlement.

Beginning April 4th, 2025, all workers’ compensation settlements involving Medicare beneficiaries that include a MSA of $750 or more, must be reported to CMS, even if the settlement was previously reported voluntarily or did not previously meet the CMS review threshold for MSA submission, which remains at $25,000. For further details regarding reporting requirements, please refer to the NGHP User Guide.

A Reminder of the Expanded Data Reporting Fields

-

- MSA Amount

- MSA Period (# of Years)

- Funding Type (Lump Sum or Annuity)

- If Structured

- Initial Deposit Amount

- Anniversary (Annual Deposit Amount)

- Case Control Number

- Professional Administrator EIN

What Does All of This Mean?

CMS wants to be made aware of settlement details. The new NGHP CMP webpage is the most recent example that CMS is focused on S111 reporting, non-compliance, review of records for auditing to identify non-compliance, penalty amounts of non-compliance, and the process of how non-compliance decisions will be handed down.

On September 12, 2024, CMS presented a webinar (click here to view presentation) on Section 111 NGHP Mandatory Reporting for Liability Insurance (including Self-Insurance), No-Fault Insurance and Workers’ Compensation. Additionally, a second webinar has been announced for another Medicare Secondary Payer & Civil Money Penalties webinar, scheduled for October 17, 2024, to provide a stage for any last-minute inquiries. CMS is taking every opportunity to promote its push for emphasis on receiving accurate and timely settlement information from RREs.

With the new expanded data requirements, very little will change in the way cases are handled by a professional administrator. On the other hand, claimants choosing to self-administer their MSA may find themselves exposed to greater risk of jeopardizing their Medicare benefits.

Reminder: Claimants who self-administer their MSA funds have hefty obligations so they do not jeopardize their Medicare benefits. These obligations include:

-

-

- MSA funds held in an interest-bearing account

- MSA funds may only be used for Medicare-covered and injury related expenses

- Keep accurate record of expenses paid out of the MSA account

- Coordination of health insurance benefits

- Annual attestation reporting submitted to Medicare

Why Choose Medivest Asure for Professional Administration

With the additional responsibility and penalties looming overhead, doesn’t it make sense to work with an experienced Professional Administrator? Medivest was the first to professionally administer a MSA Account, and has been providing this service since 1998 – longer than any other company. Asure members have their MSA accounts managed by the Medivest team who will:

-

-

- Ensure funds are spent down according to the allowable guidelines

- Communicate with doctors, pharmacists, and DME suppliers for proper billing

- Negotiate fees for medical services and future surgeries

- Coordinate benefits with other health insurance plans including Medicare

- Prepare required annual compliance documents for Medicare

- Work with the medical providers and pharmacies of your choice

- Protect Medicare entitlement by ensuring compliance with Medicare regulations

To download a Medivest Asure flyer, click here.

For Additional Information

Medivest will continue to monitor changes occurring at CMS and will keep its readers up to date when such changes are announced. For questions, feel free to reach out to the Medivest representative in your area by clicking here or call us at 855.931.3003.