Self Administration Tips for 2024

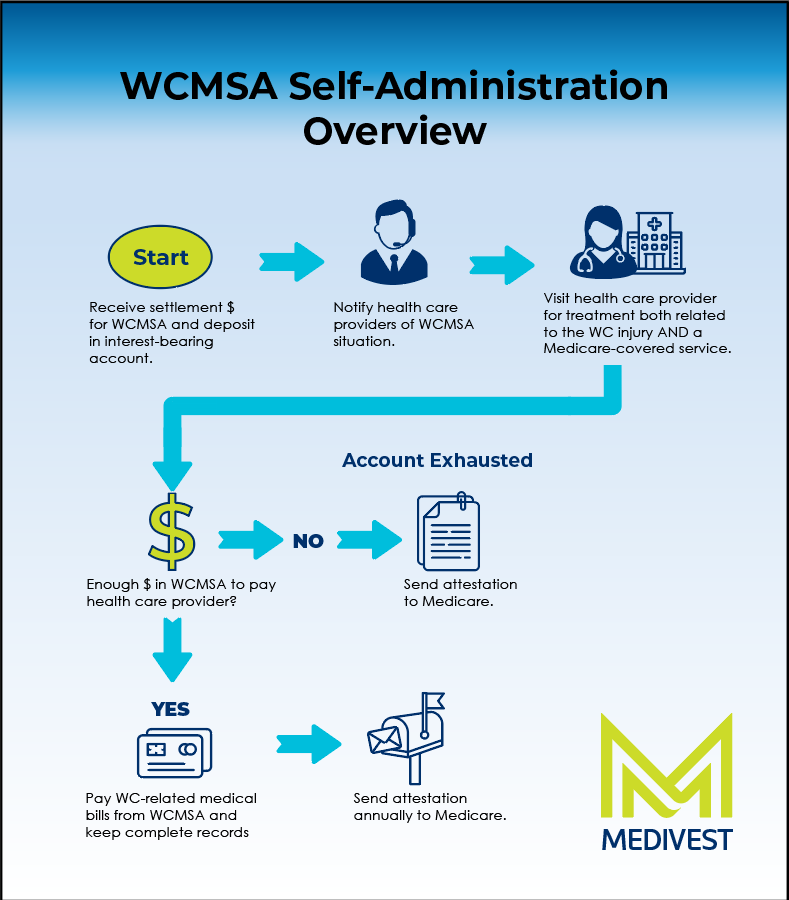

You have settled your injury case and have decided to self-administer your Medicare set-aside (MSA) arrangement. Whether you are just beginning to embark on this journey or if you have been self-administering your account for a while and need a refresher, here are a few tips you should know. These tips can help you navigate through this complicated process. They will ensure that you won’t jeopardize your Medicare benefits, help you preserve your MSA funds so they will be there when you need them the most, and will help you prepare to administer your MSA throughout 2024 and beyond.

Helpful Self-Administration Tips:

Set Up your MSA Correctly

- Know how your Medicare Set-Aside account will be funded. There are two ways to fund MSA account either with a lump-sum payment or a structured annuity. If your settlement says that it will be funded as a lump sum, one check will be issued. Or, if your settlement says that it will be funded with a structured annuity, then an initial deposit is made to establish the account, followed by annual deposits.

- Open a separate bank account to deposit your MSA funds. Do not co-mingle your MSA funds with your personal funds.

- Deposit your MSA funds into an interest-bearing bank account, insured by FDIC.

- It is recommended to find a bank that does not charge fees when you have a low balance and preferably to find an account that you could write checks on.

Learn the Process and Develop Good Habits Now

- Keep your settlement paperwork in a safe place.

- Know your date of settlement. Any expense that is injury related, Medicare covered, and has occurred after the date of settlement can be paid out of your Self-Administered Medicare Set-Aside account.

- Only use the MSA funds from your account to pay for Medicare covered medical treatment and prescription costs related to your injury, even if you are not yet enrolled in Medicare.

- Keep accurate records of the expenses you’ve paid out of your account. You will not submit these records annually, but Medicare may request these records as proof that you are using the account correctly.

- Transaction date

- Check number (if any, or transaction number if present)

- “Payable to” or health care provider name

- Date of service

- Description (procedure, service, or item received; deposit; interest; other allowable expense)

- Amount paid

- Any deposit amount

- Account balance

- Keep itemized receipts

- Banks statements

- Tax records

- You will need to send an annual attestation form every year to Medicare, no later than 30 days after the anniversary date of your Workers Compensation settlement regarding funds remaining in the account after expenses have been paid.

Know What Expenses Your MSA Covers

- MSA account can be used to pay for the following:

- Cost of copying documents

- Mailing fees/postage

- Any banking fees related to the account

- Income tax on interest income from the account

- You may not use the MSA account to pay for:

-

- Fees for trustees, custodians, or other professionals hired to help administer the account

- Expenses for administration of the MSA (other than those listed above)

- Attorney costs for establishing the MSA

- Medicare premiums, co-payments and deductibles

- To learn what expenses are considered Medicare covered. Get the free annual publication called Medicare & You from your Social Security office, or at: https://www.medicare.gov/medicare-and-you/medicare-and-you.html

What to Do When Your MSA is Exhausted or Depleted

- If you are a Medicare beneficiary and your funds have been depleted, you can forward your bills to Medicare for payment as long as the expense is Medicare covered and injury related.

- If you are not Medicare covered and your funds have been depleted, you will need to coordinate benefits with your other health insurance providers or pay out of pocket.

- When your account is permanently exhausted or depleted, which means there is no money left in the account and there will be no future deposits, you will need to submit within 60 days of the date your account is depleted a final attestation letter stating the account is ‘completely exhausted’.

- Notify Medicare’s Benefits Coordination & Recovery Center (BCRC) if death has occurred before the WCMSA is permanently exhausted.

- If you lose your Medicare entitlement, you are not entitled to release the MSA funds.

What Happens it Self-Administering is Too Difficult?

If learning how to self-administer your MSA on your own is too difficult to navigate, contact Medivest to learn more about our Self-Administration Kit with assistance. Or, if you’re interested in a more hands-off solution, Medivest Professional Administration Services can remove potential risks and the cumbersome tasks associated with administrating your Medicare Set-Aside funds, and in most cases can even stretch the lifespan of a MSA. Please call us at 877.725.2467 or reach out to us here.