Injured Medicare beneficiaries or those with a reasonable expectation of becoming enrolled in Medicare within 30 months of settlement (claimants) have a legal responsibility under the Medicare Secondary Payer statute enacted in 1980 (MSP)[1], to not prematurely bill Medicare for injury-related otherwise Medicare allowable, medical expenses (future medicals). Because many claimants and even their attorneys still don’t know the MSP law exists or how to comply with it, many settlements for claimants don’t properly consider and protect Medicare’s interests as a secondary payer for future medicals. Medicare Set-Aside (MSA) compliance programs consider Medicare’s MSP interests and implement actions to protect those interests. MSP compliance companies rely heavily on two valuable tools that work best in conjunction to achieve MSP compliance goals; a MSA allocation report (also known as a Set-Aside arrangement) estimating future medicals, and administration of MSA funds, with spending restricted to applicable future medicals. If administration of MSA settlement funds is handled by the injured claimant, it is referred to as self-administration and when performed by a company like Medivest Benefit Advisors, Inc., it is known as professional administration.

With a federal law on the books prohibiting premature billing of future medicals to Medicare and the potential for those not complying with the MSP being denied Medicare benefits for the claimed/released injury, is it wise to allow injured parties to manage and administer post settlement future medicals? The National Council on Compensation Insurance, Inc. (NCCI) recently published a research brief updating its 2014 study on Workers’ Compensation MSAs (WCMSAs) and WCMSA reviews and reported that between 2010 and 2015, approximately 98% of all WCMSAs from the study’s 11,000 MSA data sample were self-administered. That seems outrageous when injured parties are notorious for quickly spending money received from lump-sum settlements. Statistics in a personal injury practice guide by The Rutter Group indicate that somewhere between 25 and 30% of accident victims spend all settlement money within two months of receiving the funds and that up to 90% of accident victims use all settlement proceeds within five years.[3] Spending sprees seem common with lottery winners, some professional athletes, and most likely other people that come into money quickly. Congress considered the poor spending habits of settlement recipients when it enacted the Periodic Payment Settlement Act of 1982 (PPSA)[4],[5], and in subsequent related legislation.[5] Because annuity payments paid under the PPSA are paid tax-free and injured parties can often be irresponsible with their spending when they receive lump-sum settlements, structured settlements are often a wise choice to help injured parties preserve settlement funds for their needs.

Irresponsible spending of settlement funds by injured parties is sad, but when settlement funds are misspent by people other than the injured parties, it can be tragic. A Wall Street Journal article recently highlighted this risk.[7] In 1980, Nicole Herivaux lost the use of one of her arms due to alleged medical malpractice at the time of her birth in New York. In 1983, the minor’s family settled a malpractice lawsuit in exchange for a structured settlement that paid monthly annuity payments and a few hundred thousand dollars in lump sum money that could be used for Nicole’s education, among other things. The company that started making settlement payments initially deposited the annuity checks in Nicole’s mother’s name, “as guardian” of Nicole directly into a bank account. That company later transferred the responsibility for making those payments to a different insurance company in 1995, when Nicole was 15 and still a minor. Nicole Herivaux is now an adult with student loan debt and alleged in a 2018 lawsuit that the new company sent the annuity payments directly to her mother without any payment restriction or oversight and that her mother misused and inappropriately exhausted Nicole’s settlement funds. If the settlement had included professional administration of a custodial account, money intended for the minor could have paid off Nicole’s education expenses and provided her a better chance to live with peace of mind, dignity and security.

The Centers for Medicare & Medicaid Services (CMS), the regulatory body running the Medicare program and charged with the responsibility of interpreting the MSP has promulgated regulations and issued memos helpful to determining reasonable and appropriate measures to comply with the MSP. A 2011 memo from CMS’s Regional Office in Dallas from Sally Stalcup, as MSP Regional Coordinator, announced that Medicare Set-Aside is CMS’s “method of choice and the agency feels it provides the best protection for the program and the Medicare beneficiary.”[8] From the context of the Stalcup memo, it is clear the use of the term “Set-aside” included a MSA arrangement described above, and that Set-asides (MSAs) would apply in both workers’ compensation and liability cases. The Stalcup Memo also announced that “each attorney is going to have to decide, based on the specific facts of each of their cases, whether or not there is funding for future medicals and if so, a need to protect the Trust Funds.”

However, it is one thing to set money aside for the intended purpose and quite another to properly administer the money. Even when an injured claimant hires an attorney to represent them to obtain a settlement, judgment or award (“settlement”), settlement funds reserved for future medicals can be misspent. For example, attorney misconduct was found in a South Carolina Bar disciplinary case where an attorney representing a claimant failed to properly administer funds set aside to protect Medicare’s interests (MSA funds) as a secondary payer for future medicals.[9] In another bar disciplinary case, an Illinois licensed attorney used trust funds for improper purposes when the trust funds were to be maintained in trust until it was determined whether they belonged to the attorney’s client or Medicare.[10]

Did the attorneys in these matters know how to report settlements to CMS’ Benefits Coordination & Recovery Center (BCRC) contractor, how to request Medicare conditional payment amounts, perform bill review and potentially dispute and finalize conditional payment lien amounts? Did they consider whether their client’s injury and/or financial condition might lend itself to a conditional payment lien compromise or waiver request? Furthermore, did the attorneys know how to properly administer the MSA funds that were set aside for their clients’ future medicals? If the attorneys had sought the advice of a competent company that performs these functions regularly, they would have been in a better position to protect their clients, protect the Medicare Trust Funds and protect their professional standing.

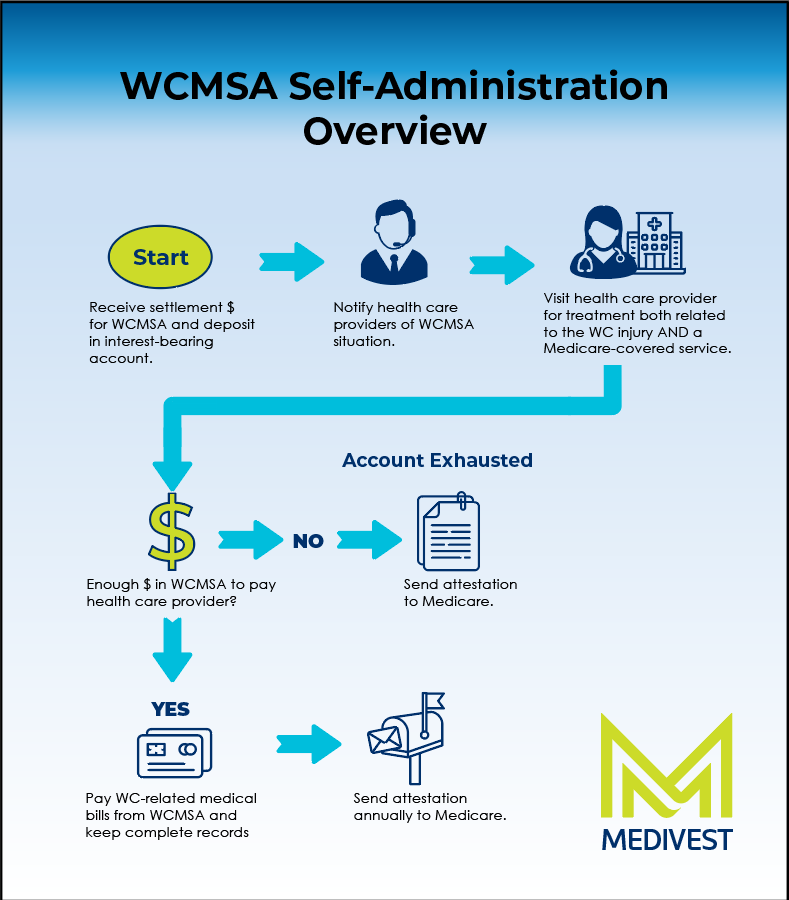

Allowing incompetent, injured claimants to self-administer their own MSA accounts cannot be a prudent way to protect Medicare’s interests in preserving the nation’s Medicare Trust Funds. Even competent claimants likely experience difficulties attempting to self-administer MSA funds. While CMS makes resources available to individuals intending to self-administer an MSA account including a WCMSA Reference Guide and a Self-Administration Tool Kit, but what percentage of injured claimants will read and follow the protocol of the 127-page WCMSA Reference Guide and the 31-page Self-Administration Tool Kit?

Self-administration is surely harder than filing a standard federal income tax return. Plenty of people find it helpful to use professional assistance or digital software to help them file their tax return. [11] A self-administering claimant needs to evaluate bills for medical items and expenses, including prescription drug expenses, to verify that they are both injury-related, Medicare allowable and otherwise reimbursable. Once bills are reviewed, a decision still needs to be made as to how much should be paid. Is the provider a Medicare-approved provider? Should the amount be the Medicare allowable rate, the provider’s bill rate or the usual and customary rate? Is there a Group Health Insurance plan involved? Does it matter if the case stems from a liability case versus a workers’ compensation claim? Does the Code of Federal Regulations say anything about these distinctions? Does CMS provide guidance in this area via its website, its Medicare Learning Network, or WCMSA Reference Guide? Have there been any cases evaluating these issues and was the claimant’s injury in a jurisdiction where case law might affect the amount of money to be set aside for those future medicals? Will a claimant be able to keep records on their own sufficient to withstand CMS scrutiny to determine whether MSA account spending is MSP compliant? Will the claimant remember to prepare and transmit required annual attestations of MSP accounting compliance? Because the answer to these questions is only part of the MSP compliance puzzle, it is little surprise that CMS announced professional administration as recommended for MSA fund administration. In addition to providing a full array of Professional Administration services, Medivest also offers a Self-Administration Kit service that provides customer service and claims support as well as discounts on durable medical equipment and prescription medication to help competent claimants take on self-administration.

[1] 42 U.S.C. § 1395y(b).

[2] The Rutter Group, “California Practice Guide: Personal Injury” Chapter 4.

[3] Re: Section 130 Qualified Assignments, 2003 WL 22662008, at *3 (legislative history to the PPSA detailed that additions to the law helped provide certainty that periodic payments of personal injury damages are excluded from the gross income of the recipient. S. Rep. No. 97-646, 97th Cong., 2d Sess. 4 (1982)).

[4] Periodic Payment Settlement Act of 1982 (PL 97–473 (HR 5470), PL 97–473, January 14, 1983, 96 Stat 2605) (through tax benefits, the PPSA encourages use of structured settlements to resolve personal physical injury and physical sickness cases).

[5] Re: Section 130 Qualified Assignments, 2003 WL 22662008, at *18 (The public policy encouraging use of structured settlements by providing a tax subsidy was affirmed in JCX-15-99, the Joint Committee on Taxation, Tax Treatment of Structured Settlement Arrangements from March 16, 1999 (pointing out perils of lump sum settlements when “. . . the individual may, by design or poor luck, mismanage his or her funds so that future medical expenses are not met.” JCX 15-99 accompanied H.R. 263, “The Structured Settlement Protection Act,” 106th Cong., 1st Sess. Section 5891 of the Code enacted by a subsequent version of that bill, H.R. 2884, on January 23, 2002).

[6] Under Section 104(a) of the Internal Revenue Code (I.R.C.), personal injury settlement proceeds are tax-free, but when paid in a lump sum, any investment earnings or interest paid on those funds as they grow over time is taxable. Pursuant to Section 104(a)(2) of the I.R.C., each structured settlement payment over the entire period of payment of the annuity stream is tax-free to the victim. The details of taxable consequences associated with interest gained after receipt of each annuity should be evaluated with a licensed tax professional in conjunction with a structured settlement advisor.

[7] Leslie Scism, Lawsuit Alleges MetLife Mistake Helped a Woman Keep Settlement Money From Her Daughter Insurer faces lawsuit over structured-settlement annuity related to old business, WALL STREET JOURNAL., February 21, 2018.

[8] Sally Stalcup, MSP Regional Coordinator, Region VI (May 25, 2011, Handout).

[9] In the Matter of Morris, 343 S.C. 651, 653-54, 541 S.E.2d 844, 845 (2001).

[10] In the Matter of: Charles Augustus Boyle, Attorney-Respondent, No. 268739, 2014 WL 10505032, at *2. (Attorney voluntarily relinquished his license to practice law after an investigation revealed among other misconduct, that he failed to pay his client’s medical bills from settlement proceeds in one case, failed to deposit settlement proceeds into a guardianship account established on behalf of a minor in another case, failed to notify Medicare that four other cases settled and failed to pay the Medicare conditional payment liens for those four cases).

[11] Excluding those individuals who responded “none of the above” to the question of how they file their taxes, gobankingrates.com reports from an internet poll that of just over 5,000 people, 36.8% said they use either an accountant (28.5%) or a brick and mortar tax company like H&R Block (8.3%) and 34.5% responded that they use tax filing software.